An overview of our business

Our group comprises three main segments: Unifiedcomms, GlobeOSS and Captii Ventures.

Throughout 2023, Unifiedcomms continued to address mobile network operators and integrated telecoms service providers with application and platform software, turnkey solutions and systems and a variety of professional and managed services. In 2016 a unit within Unifiedcomms called PostPay was revitalised into a fresh start- up and given prominence as part of a wider reorganisation of the Unifiedcomms business. PostPay focuses mainly on providing advanced solutions for prepaid credit on a managed service model.

GlobeOSS meanwhile, has developed into Malaysia's leading systems integration and solutions provider in the field of telecoms big data and analytics.

Unifiedcomms operates primarily in the telecoms-tech markets of three regions: South East Asia (SEA), South Asia (SA) and the Middle East and Africa (MEA) while GlobeOSS focuses exclusively on SEA. For Unifiedcomms, with the exception of Malaysia, Singapore and Pakistan, where engagement with the customer is conducted directly by our own personnel, the majority of our engagements with customers are carried out through various sales channel partners. This two-tier sales and distribution approach enables us to cost-effectively reach customers within each region of focus and to tap into the local knowledge and insights of our partners to build and deliver compelling solutions.

Captii Ventures, the venture investment arm of our group, focuses primarily on the SEA market for start-up investment opportunities. Our venture investment business regularly interacts with other venture capital (VC) management companies in the region and participates in funding rounds as either lead investor or as a co-investor following the lead investor.

As at end-2023, there are a total of 190 people that are employed in our group. The majority of these personnel are located in Malaysia, where our operational headquarters is situated, while the rest work out of Singapore, Pakistan, Brunei, Thailand and Indonesia.

A slow and disappointing year

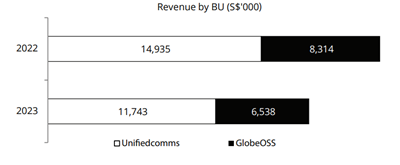

The group recorded consolidated revenue of S$18.3 million for the financial year 2023, a decrease of 21.4% as compared to the S$23.2 million achieved in 2022.

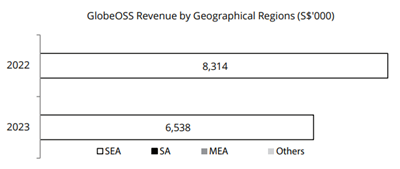

Both GlobeOSS and Unifiedcomms businesses recorded a decline in revenue against their 2022 results. GlobeOSS recorded revenue of S$6.5 million in 2023, a decrease of 21.4% from the S$8.3 million achieved in 2022. Unifiedcomms meanwhile had a 21.4% decline in revenue, turning in total revenue of S$11.7 million in 2023 versus S$14.9 million the year before.

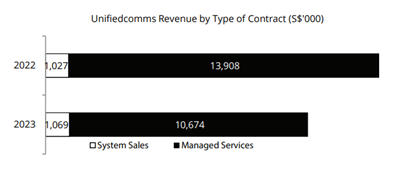

Lower revenue at Unifiedcomms was caused by revenue from managed service contracts declining to S$10.7 million in 2023 from S$13.9 million in 2022. System sales contract revenues of this business in 2023 meanwhile were flat against 2022.

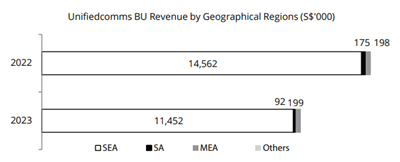

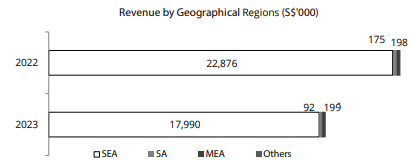

The Unifiedcomms customer base has traditionally been concentrated in the SEA region. This has not changed in 2023, with Unifiedcomms SEA region revenues accounting for 97.5% of total revenue recorded for the year.

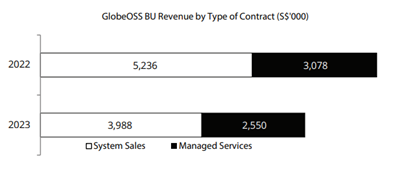

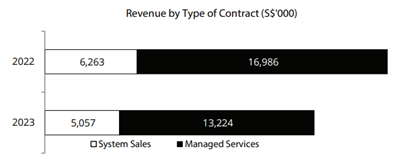

GlobeOSS also experienced a decline in both system sale and managed service contract revenues in 2023. System sale contract revenues declined to S$4 million in 2023 versus the S$5.2 million achieved in 2022. Managed service contract revenues declined to S$2.6 million in 2023 versus the S$3.1 million achieved in 2022.

GlobeOSS continues to have both its system sale and managed service business concentrated in the SEA region. The decrease in GlobeOSS revenue from the SEA region reflects the S$1.2 million decrease in system sale contract revenues between 2022 and 2023.

Decline in both system sale and managed service revenues

The decline in group revenue this year against last year was mainly attributable to the 22.2% or S$3.8 million decrease in both Unifiedcomms and GlobeOSS managed service contract revenues and the 23.8 % or S$1.2 million decrease in GlobeOSS system sale contract revenues.

The revenue region that proved most disappointing was SEA, which had its contribution fall from S$22.9 million in 2022 to S$18 million in 2023. Similarly, the SA region's results were below expectations, due to the underperformance of certain managed service contracts, coupled with impact of unfavourable foreign exchange movements. The MEA region's contribution to total group revenue at S$0.2 million this year was flat against the year before.

In 2023, SEA, our home region, continues to be the largest geographic source of revenue, accounting for 98.4% of group topline.

Lower gross profit in line with lower revenue

In line with the lower consolidated revenue of S$18.3 million for 2023, a 21.4% decrease on 2022 revenue, absolute gross profit recorded for the year was lower compared to 2022.

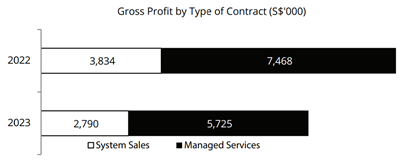

Group gross profit for 2023 was S$8.5 million, down by S$2.8 million or 24.6% against what was recorded in 2022. The magnitude of decline in gross profit was higher than that of revenue as a result of the less favourable sale mix recorded in 2023, attributable to lower overall gross profit margin earned on group revenue of 46.6% as compared to 48.6% achieved the year before.

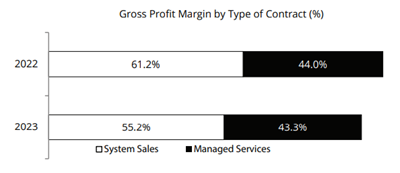

System sale contract average gross profit margin declined to 55.2% in 2023 as compared to 61.2% achieved in 2022. This was primarily due to lower Unifiedcomms system sale contracts gross profit margin in 2023, attributable to higher third-party costs. Meanwhile, gross profit margin earned on managed service contract revenues declined marginally from 44% achieved in 2022 to 43.3% this year. This was primarily due to higher third-party costs on certain Unifiedcomms managed service contracts.

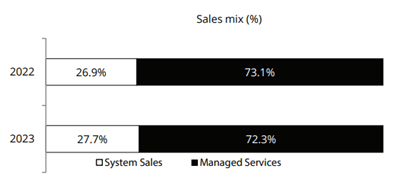

The sales mix of our group in 2023 continues to show more than fifty percent of group revenue being generated from managed service contracts. This year's managed service contract revenues accounted 72.3% of group revenue, down from 73.1% in 2022. This was primarily due to a decrease in managed service contract revenues of the group, which declined by 22.1% from S$17 million in 2022 to S$13.2 million in 2023.

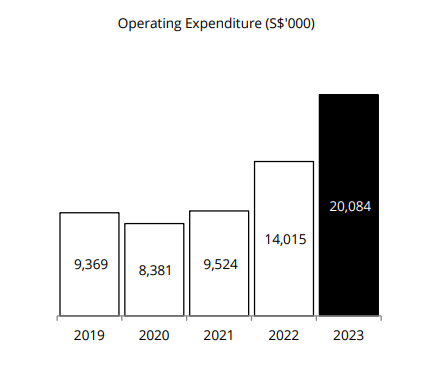

Higher total opex, after exceptional Items

Our group's operating expenditure for the year increased significantly to S$20.1 million this year as compared to S$14 million in 2022.

In 2023, we had a significant impairment loss on goodwill and a fair value loss being assessed on our group's venture investment portfolio.

The impairment loss on goodwill this year amounting to S$4.2 million represented the amount by which the carrying amount of cash-generating unit ("CGU") of Unifiedcomms had exceeded its recoverable amount. This was mainly caused by certain managed services contracts (under the CGU) that are now believed to produce lower than expected profitability and returns. This impairment loss has no cash impact.

Meanwhile, the challenging market environment for technology startup valuations resulted in a significant decline in the fair value of the group's venture investment portfolio this year. This gave rise to the fair value loss of S$6.8 million in 2023 as compared to S$2.1 million in 2022.

Moreover, we sustained a further foreign exchange loss during the year, primarily due to the continued weakening of the Pakistan Rupee against the Singapore Dollar.

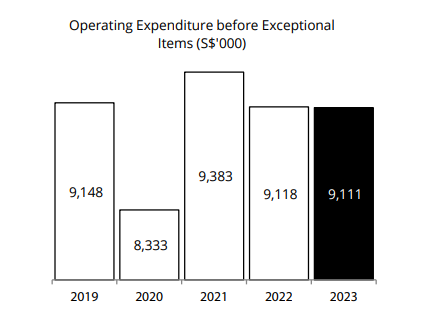

Excluding the effect of exceptional items charged to the income statement this year such as the fair value loss and impairment loss on goodwill, our group operating expenditure for 2023, at S$9.1 million, is unchanged compared to what was recorded for 2022.

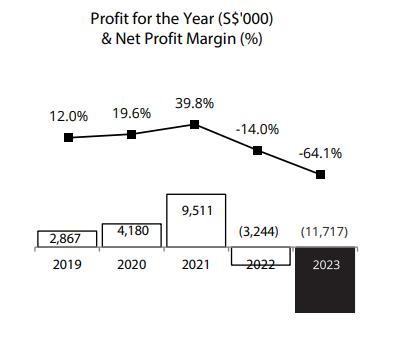

Negative bottom line from large non-cash charges

The group net loss for the year was S$11.7 million, some 261% higher than the S$3.2 million net loss recorded in 2022. This increase in our group's negative bottom line caused by the higher fair value loss and impairment loss on goodwill totalling S$11 million as compared to S$4.9 million recorded in 2022. These exceptional losses had no cash impact on our business.

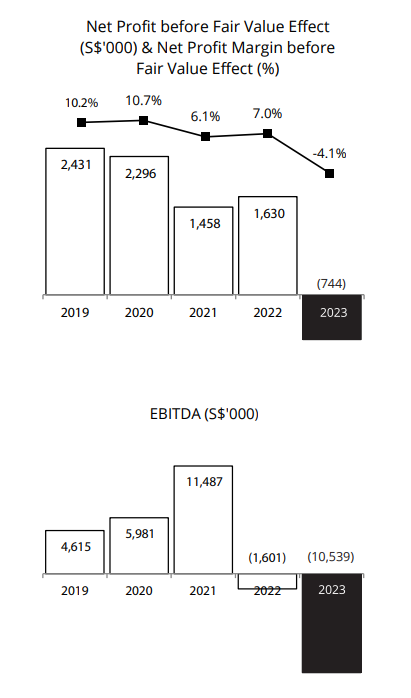

In terms of margins, our group recorded a negative net profit margin of 64.1% for 2023, as compared to the 14% recorded in 2022. If the effect of any fair value and impairment loss are excluded, our group net loss margin for 2023 would have reduce to 4.1%, as compared to net profit margin of 7% achieved in 2022.

When the bottom-line numbers are examined more closely, to exclude exceptional losses such as the fair value on the Captii Ventures portfolio investments, and the impairment loss on goodwill, the profit performance of Unifiedcomms and GlobeOSS is made more apparent. Excluding such non-cash items, Unifiedcomms and GlobeOSS recorded an 'adjusted' net loss of S$0.7 million in 2023, in contrast with the 'adjusted' net profit of S$1.6 million in 2022. The decline in the performance of the underlying business of Unifiedcomms and GlobeOSS was mainly due to declines in revenue and gross profit margin.

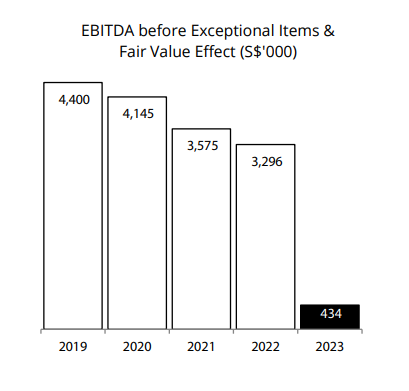

We recorded negative EBITDA of S$10.5 million in 2023, in tandem with our group's net loss result for the year. A significant proportion of this negative EBITDA is accounted for by the fair value loss on the Captii Ventures investment portfolio and the impairment loss on goodwill. Removing the effect of these non-cash items in 2023, the cash generation performance of our underlying businesses can be identified. EBITDA before exceptional items stood at S$0.4 million for 2023 - a decrease of 86.8% against what was achieved in 2022.

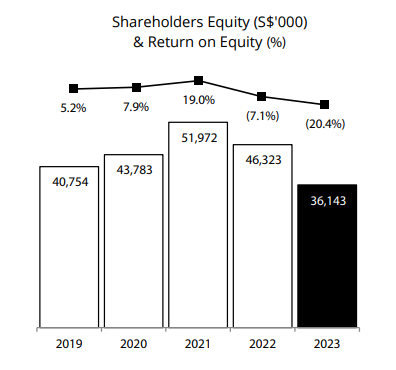

Because of the exceptional losses, our group recorded a negative return on equity (ROE) of 20.4% for the year.

Investing in (external) technology and innovation

As at end-2023, we continued to have sufficient capital to augment our organic growth plans with growth by strategic investment. This remains an essential element of our current business plan that targets sustained and double-digit group profit growth, and a significant uplift of our ROE performance.

Throughout 2023, our venture investment business persisted in identifying and evaluating many investment opportunities in the SEA region, unfortunately none could be progress to consummation. We ended 2023 with a portfolio of eight remaining investments in new technology ventures and startups.

Reviewing our 2023 balance sheet

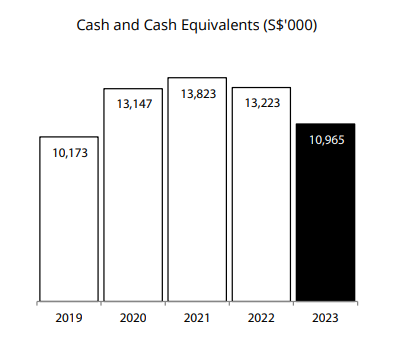

Now to turn to our group's balance sheet: we ended 2023 with lower current assets of S$24.3 million, as compared to S$27.9 million as at end-2022. This was mainly attributable to the decrease in trade and other receivables from S$11.2 million to S$8.7 million as a result of lower revenue recorded by our group. This impact was partly mitigated by the increase in other non-financial assets from S$3.4 million to S$4.6 million as a result of higher contract assets. The increase in contract assets relates to higher uncompleted system sale contracts of our GlobeOSS business in 2023. The group's cash and cash equivalents as at end-2023 meanwhile stood at S$11 million as compared to S$13.2 million as at end-2022.

Our total non-current assets declined from S$35.3 million as at 31 December 2022 to S$23.8 million as at 31 December 2023, representing a decrease of 32.5%. This was mainly due to the decrease in other financial assets as a result of the significant non-cash fair value loss assessed on the venture investment portfolio as at 2023, as well as the impairment loss on goodwill (classified as intangible assets).

Total liabilities of our group fell from S$6.4 million as at 31 December 2022 to S$5.4 million as at 31 December 2023. This decrease is attributable to the reduction in trade and other payables following payments made in 2023.

Reviewing movements in group cash

Our group's net cash generated from operations was S$0.3 million in 2023, in contrast with the net cash used in operations of S$0.2 million in the previous year. This was mainly attributable to lower working capital incurred of S$0.2 million for 2023, as compared to S$3.5 million for 2022, as higher repayment was made to the trade and other payables in 2022.

Our group's net cash used in investing activities for 2023 amounted to S$0.5 million, in contrast with the net cash flow from investing activities of S$2 million in 2022. This decrease was primarily due to significantly lower proceeds from the disposal of a venture investment in 2023 as compared to 2022.

The group's net cash used in financing activities for 2023 amounted to S$1.1 million as compared to S$0.6 million for 2022. The higher net cash used in financing activities was mainly due to higher repayment of borrowings in 2023. These borrowings relate to working capital financing facilities utilised for certain system sale contracts.

Recurring revenues remain strong

We expected system sale market conditions to continue to be somewhat challenging for our group in 2023 and for our managed service contract portfolio to deliver significant growth. The decline in GlobeOSS system sale contract revenues in 2023 evidenced the lumpiness that is to be expected in the contribution of system sale contracts to the group's result. Meanwhile, the growth in our managed service contract portfolio did not materialize. Both Unifiedcomms and GlobeOSS recorded lower managed service contract revenues due to underperformance of certain existing managed service contract, coupled with adverse effect of unfavourable foreign exchange rate movements.

Significant uncertainty and lumpiness are still to be expected in the contribution of system sale contracts to our group's future results. The need for our group to continue to strengthen our managed service contract portfolio and to continue to grow our venture investing business as the basis for delivering steady, if not rapid yet sustainable future growth, remains.

Challenges and opportunities in 2024 and beyond

The operations of Unifiedcomms and GlobeOSS in the financial year under review had been minimally impacted by geopolitical tensions and supply chain disruption. However, due to the diminished expected performance of certain managed service contracts the value of Unifiedcomms as a CGU was adversely affected. The change in user behaviour in certain Unifiedcomms applications services, followed by the intensified pricing pressure within the telecommunications industry had directly and indirectly impacted the expected profitability of these managed service contracts, resulting in a significant reduction in the valuation of Unifiedcomms as a CGU in 2023.

On the business front, both Unifiedcomms and GlobeOSS contracts in-hand continue to be progressed and management of the group are hopeful that new projects and initiatives requiring our products and services, will continue to be pursued by customers. The possibility remains however, that larger system sale contracts and certain managed service contracts that have yet to be committed in the financial year under review, may be further deferred, or even abandoned entirely if macroeconomic and industry conditions worsen or do not improve significantly enough.

At Captii Ventures, the group's venture investment business, the valuation for start-ups continue to be affected by a weak market environment. This resulted in a substantial reduction in the fair value of Captii Ventures' investment portfolio, translating to a fair value loss of S$6.8 million in the financial year under review.

Against this rather negative backdrop the group remains optimistic and will continue to work closely with customers and investees, to minimise the negative impact of economic uncertainty on group financial performance.

| Wong Tze Leng | Anton Syazi Ahmad Sebi |

|---|---|

| Executive Chairman | Executive Director |

18 March 2024